Which Result Can Be Expected From an Increase in the Supply of Bonds?

Fiscal and Budgetary Policies and IS-LM Bend Model!

Effect of Fiscal Policy:

Let united states commencement explain how IS-LM model shows the effect of expansionary fiscal policy of increment in Authorities expenditure on level of national income.

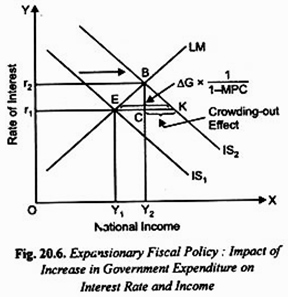

This is illustrated in Fig. xx.6. Increase in Regime expenditure which is of democratic nature raises aggregate demand for goods and services and thereby causes an outward shift in IS curve, as is shown in Fig. 20.half dozen where increment in Government expenditure leads to the shift in IS curve from IS1 to IStwo.

Note that the horizontal distance betwixt the two IS curves is equal to the increment in government expenditure times the government expenditure multiplier, that is, ΔG x 1/1-MPC which shows the increase in national income equal to the horizontal distance EK that occurs in Keynes' multiplier model. Nonetheless, in IS-LM model actual increment in national income is non equal to EK caused past the working of Keynesian multiplier.

This is considering with the rightward shift in IS bend rate of involvement also rises which causes reduction in private investment. It will exist seen from Fig. 20.6 that, with the LM bend remaining unchanged, the new IStwo bend intersects LM curve at betoken B. Thus, in IS-LM model with the increment in Government expenditure (ΔG), the equilibrium moves from point East to B and with this the rate of involvement rises from ri to rii and income level from Y1 to Yii.

Income equal to CK has been wiped out because of rise in interest causing a decline in private investment. Thus CK represents crowding-out issue of increase in government expenditure Thus, IS-LM model shows that expansionary fiscal policy of increase in Regime expenditure raises both the level of income and rate of interest.

Information technology is worth noting that in the IS-LM model increase in national income by Yi Y2 in Fig. 20.6 is less than EK which would occur in Keynes' model. This is because Keynes in his elementary multiplier model assumes that investment is stock-still and autonomous, whereas IS-LM model takes into account the fall in private investment due to the ascent in involvement rate that takes place with the increase in Government expenditure. That is, increase in Government expenditure crowds out some private investment.

Likewise, it tin be illustrated that the reduction in Regime expenditure will cause a leftward shift in the IS bend, and given the LM curve unchanged, will lead to the fall in both rate of interest and level of income. It should be noted that Government often cuts expenditure to control aggrandizement in the economy.

Expansionary Financial Policy: Reduction in Taxes:

An alternative measure of expansionary fiscal policy that may exist adopted is the reduction in taxes which through increase in disposable income of the people raises consumption demand of the people. As a outcome, cut in taxes causes a shift in the IS curve to the right every bit is shown in Fig. twenty.seven from ISi to IS2.

It may however be noted that in the Keynesian multiplier model, the horizontal shift in the IS curve is adamant by the value of tax multiplier times the reduction in taxes (ΔT), that is, ΔT x MPC/ane-MPC and causes level of income to increase past EH.

Still, in the IS-LM model, with the shift of the IS curve from IS1 to IS2 following the reduction in taxes, the economic system moves from equilibrium indicate E to D and, as is evident from Fig. 20.7, rate of interest rises from rane to rtwo and level of income increases from Yone to Y2. Income equal to LH has been wiped out because of crowding-out issue on private investment as a result of rise in involvement rate.

On the other hand, if the Government intervenes in the economy to reduce inflationary pressures, it will raise the rates of personal taxes to reduce dispensable income of the people. Rising in personal taxes will pb to the subtract in amass demand. Decrease in aggregate demand will help in controlling inflation. This instance can as well be shown by IS-LM bend model.

Part of Budgetary Policy to Ensure Economic Stability: Explained through IS-IM Bend Model:

Through making advisable changes in monetary policy the Authorities tin can influence the level of economic activity. Monetary policy may also be expansionary or contractionary depending on the prevailing economic situation.

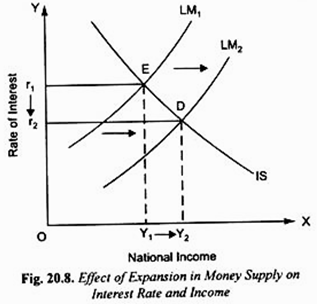

IS-LM model can be used to bear witness the outcome of expansionary and tight monetary policies. A change in money supply causes a shift in the LM curve; expansion in money supply shifts it to the right and decrease in money supply shifts information technology to the left.

Suppose the economy is in grip of recession, the Government (through its Central Depository financial institution) adopts the expansionary monetary policy to lift the economic system out of recession. Thus, it takes measures to increase the money supply in the economy. The increase in money supply, state of liquidity preference or demand for coin remaining unchanged, volition lead to the autumn in rate of interest.

At a lower interest there will be more investment past businessmen. More than investment volition cause aggregate demand and income to rise. This implies that with expansion in money supply LM curve will shift to the correct equally is shown in Fig. xx.eight.

As a issue, the economic system volition move from equilibrium signal Due east to D and with this the rate of interest will fall from r1 to r2 and national income will increase from Yi to Y2. Thus, IS-LM model shows that expansion in coin supply lowers involvement charge per unit and raises income.

We accept as well indicated what is called monetary transmission mechanism, that is, how IS-LM bend model shows the expansion in money supply leads to the increase in aggregate demand for goods and services. We have thus seen that increment in money supply lowers the rate of interest which then stimulates more investment demand. Increase in investment demand through multiplier process leads to a greater increase in aggregate demand and national income.

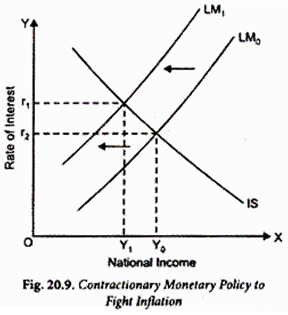

If the economy suffers from inflation, the Government will like to bank check it. And then its Central Bank should adopt tight or contractionary budgetary policy. To command aggrandizement the Fundamental Depository financial institution of a country can reduce coin supply through open market operations by selling bonds or government securities in the open up market and in return gets currency funds from those who buy the bonds. In this style liquidity in the banking arrangement can be reduced.

To reduce money supply for fighting aggrandizement the Fundamental Bank can also raise cash reserve ratio of the banks. The college cash reserve ratio implies that the banks take to keep more cash reserve with the Cardinal Banking concern. As a result, the cash reserves with the banks fall which forcefulness them to contract credit. With this coin supply in the economic system declines.

Thus, IS-LM model can be used to show that reduction in coin supply will cause a leftward shift in LM curve and will lead to the ascension in interest rate and fall in the level of income. The rise in interest rate which volition cause reduction in investment demand and consumption demand and aid in controlling inflation. This is shown in Fig. 20.ix.

Source: https://www.economicsdiscussion.net/is-lm-curve-model/fiscal-and-monetary-policies-and-is-lm-curve-model/10586

Enregistrer un commentaire for "Which Result Can Be Expected From an Increase in the Supply of Bonds?"